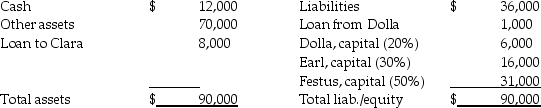

The partnership of Dolla,Earl,and Festus was dissolved on January 1,2014.The balance sheet at that date is shown below:

In January,$34,000 of the accounts receivable was collected,and an additional $6,000 was determined to be uncollectible.The remaining receivables are still expected to be collected.

In January,$34,000 of the accounts receivable was collected,and an additional $6,000 was determined to be uncollectible.The remaining receivables are still expected to be collected.

Required:

Determine how the available cash on January 31,2014 will be distributed.(Use a safe payments schedule.)

Definitions:

Miller-Orr Model

A financial model used to manage cash balances by setting upper and lower limits on cash reserves within which no financing is needed.

Cash Balance Target

A financial strategy that involves setting a specific amount of cash reserves that a company aims to maintain to meet future expenses, emergencies, or investment opportunities.

Interest Rate

The fee a lender imposes on a borrower for utilizing assets, represented as a percentage of the principal amount.

Collection Float

The time period between when a check is deposited in a bank and when the funds are available, impacting the company's cash flow.

Q14: Government-wide financial statements exclude the<br>A)general fund.<br>B)fiduciary funds.<br>C)proprietary

Q21: Ivan has 14,000 barrels of oil

Q33: A researcher can find tax information on

Q35: In reference to the probate process,which of

Q37: How much cash would Able receive from

Q50: Enterprise funds are accounted for in a

Q50: When the bankruptcy court grants an order

Q75: More than 25% gross income omission and

Q160: Failure to file penalty

Q167: A Federal deduction for state and local