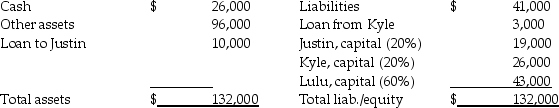

The Justin,Kyle,and Lulu partnership was dissolved by the partners on May 1,2014.Their balance sheet on that date is shown below:

In May,other assets with a book value of $46,000 were sold for $50,000 in cash.

In May,other assets with a book value of $46,000 were sold for $50,000 in cash.

Required:

Determine how the available cash on May 31,2014 will be distributed.

Definitions:

Living Conditions

The circumstances or factors affecting the way in which people live, including their housing, health, and ability to meet basic needs.

Social Entrepreneurship

The practice of creating businesses with the primary goal of achieving social impact rather than maximizing profits alone.

Multiple Sources

Relying on or referring to more than one origin or point of information.

Government Contracts

Agreements entered into by government entities and private companies or individuals for the provision of goods, services, or execution of works.

Q15: Jeale Corporation is preparing its interim financial

Q21: The Securities and Exchange Commission requires the

Q23: Enterprise funds use full accrual accounting procedures.

Q24: Gains and losses incurred at liquidation are

Q32: In reference to the potential taxation of

Q36: In recent years, Congress has been relatively

Q36: No constructive gain or loss arises from

Q44: Partel Corporation purchased 75% of Sandford Corporation

Q81: No return and statute limitations

Q171: Fraud and statute of limitations