Use the following information to answer the question(s) below.

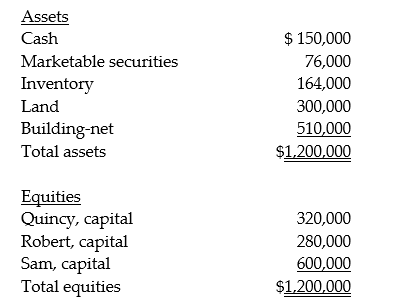

Quincy has decided to retire from the partnership of Quincy, Robert, and Sam. The partnership will pay Quincy $400,000. Total partnership capital should be revalued based on the excess payment to Quincy. (Assume the book values of the assets listed below equals fair values.) A summary balance sheet for the Quincy, Robert, and Sam partnership appears below. Quincy, Robert, and Sam share profits and losses in a ratio of 1:1:3, respectively.

-What partnership capital will Robert have after Quincy retires?

Definitions:

Support Staff

Employees who provide essential services that help an organization run smoothly, but who are not part of the core function like production or sales.

Track of Contacts

The process of systematically recording and maintaining information on interactions or communications with individuals or entities.

Be Patient

An admonition to wait calmly for something to happen or be resolved.

Career Advancement

The process of moving up in professional rank or position, often accompanied by increased responsibilities, prestige, and salary.

Q1: When liquidating a partnership the first payment

Q13: A taxpayer must pay any tax deficiency

Q16: Not-for-profit health care organizations present a statement

Q16: A statement of realization and liquidation is

Q18: Under the parent company theory,what amount of

Q24: On December 15,2014,Electronix Company purchased inventory from

Q27: What is the fair value of the

Q41: A U.S.parent corporation loans funds to a

Q47: On January 1,2014,Wrobel Company acquired a

Q81: No return and statute limitations