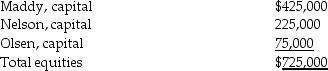

A summary balance sheet for the partnership of Maddy,Nelson and Olsen on December 31,2014 is shown below.Partners Maddy,Nelson and Olsen allocate profit and loss in their respective ratios of 9:6:10.

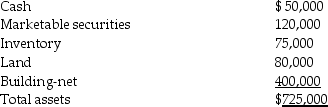

Assets

Equities

Equities

The partners agree to admit Poosh for a one-tenth interest.The fair market value for partnership land is $180,000,and the fair market value of the inventory is $150,000.

The partners agree to admit Poosh for a one-tenth interest.The fair market value for partnership land is $180,000,and the fair market value of the inventory is $150,000.

Required:

1.Record the entry to revalue the partnership assets prior to the admission of Poosh.

2.Calculate how much Poosh will have to invest to acquire a 10% interest.

3.Assume the partnership assets are not revalued.If Poosh paid $200,000 to the partnership in exchange for a 10% interest,what is the bonus that is allocated to each partner's capital account?

Definitions:

Allowance for Doubtful Accounts

A reserve account used to estimate the amount of receivables that may not be collectible.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or within the normal operating cycle of the business, whichever is longer.

Allowance for Doubtful Accounts

A contra-asset account that represents the amount of accounts receivable a company does not expect to collect.

Accounts Receivable

The money owed to a business by its customers for goods or services that have been delivered or sold but not yet paid for.

Q14: What is the goodwill on the consolidated

Q20: In a nongovernmental,nonprofit hospital,contractual adjustments are<br>A)the discounted

Q21: The Securities and Exchange Commission requires the

Q30: Under the entity theory,subsidiary assets and liabilities

Q36: The balance sheet of the Park,Quid,and Reggie

Q44: The following are transactions for the city

Q44: Pachelor Corporation owns 70% of the outstanding

Q48: Controlling interest share in consolidated net income

Q81: The U.S. Tax Court meets most often

Q179: Early filing and statute of limitations (deficiency