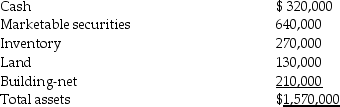

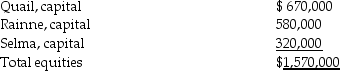

A summary balance sheet for the partnership of Quail,Rainne and Selma on December 31,2014 is shown below.Partners Quail,Rainne and Selma allocate profit and loss in their respective ratios of 6:3:1.

Assets

Equities

Equities

The partners agree to admit Trask for a one-tenth interest.The fair market value for partnership land is $260,000,and the fair market value of the inventory is $370,000.

The partners agree to admit Trask for a one-tenth interest.The fair market value for partnership land is $260,000,and the fair market value of the inventory is $370,000.

Required:

1.Record the entry to revalue the partnership assets prior to the admission of Trask.

2.Calculate how much Trask will have to invest to acquire a 10% interest.

3.Assume the partnership assets are not revalued.If Trask paid $300,000 to the partnership in exchange for a 10% interest,what would be the bonus that is allocated to each partner's capital account?

Definitions:

Allowance for Doubtful Accounts

A contra-asset account used to estimate the portion of receivables that may not be collectible.

Contra Asset

An account on a company's balance sheet that reduces the total amount of an asset, such as accumulated depreciation.

Normal Balance

In accounting, the normal balance is the side (debit or credit) of an account that is usually increased. For example, asset accounts normally have a debit balance, while liabilities and equity accounts have a credit balance.

Direct Write-off Method

A method of accounting for bad debts that involves charging the amount of an uncollectible account directly to the expense account when it is deemed non-recoverable.

Q1: When liquidating a partnership the first payment

Q3: Palomba Corporation allocates consolidated income taxes to

Q11: For reporting purposes,a segment is considered material

Q16: If a U.S.company wants to hedge a

Q27: The primary goal behind consolidating financial statements

Q30: A simple partnership liquidation requires<br>A)periodic payments to

Q36: Paroz Corporation acquired a 70% interest in

Q40: Contractual adjustments are discounts arranged with third-party

Q47: Pollek Corporation paid $16,200 for a 90%

Q48: Floating exchange rates reflect fluctuating market prices