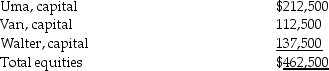

A summary balance sheet for the Uma,Van,and Walter partnership on December 31,2014 is shown below.Partners Uma,Van,and Walter allocate profit and loss in their respective ratios of 4:5:7.The partnership agreed to pay Walter $227,500 for his partnership interest upon his retirement from the partnership on January 1,2015.Any payments exceeding Walter's capital balance are treated as a bonus from partners Uma and Van.

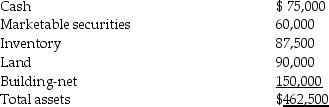

Assets

Equities

Equities

Required:

Required:

Prepare the journal entry to reflect Walter's retirement.

Definitions:

Selling

The process of persuading customers to purchase goods or services from a company.

Administrative Expense

Expenses related to the management and overall operations of a company, which do not directly tie to the manufacturing or selling of products or services.

Office Facilities

Spaces and related services necessary for a business to function, including buildings, equipment, and utilities.

Selling

The process of persuading someone to buy a product or service.

Q1: A foreign subsidiary's foreign currency statements must

Q1: In computing consolidated diluted EPS,the replacement calculation

Q3: Gains and losses from foreign currency transactions

Q14: Accounts representing an allowance for uncollectible accounts

Q21: Consider a sale of stock by a

Q21: The following are transactions for the city

Q25: When a company attempts to control the

Q40: Parrot Company owns all the outstanding voting

Q64: Failure to pay penalty

Q80: Which statement is incorrect with respect to