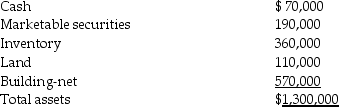

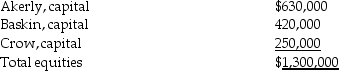

A summary balance sheet for the Akerly,Baskin,and Crow partnership on December 31,2014 is shown below.Partners Akerly,Baskin,and Crow allocate profit and loss in their respective ratios of 3:2:1.The partnership agreed to pay partner Baskin $500,000 for his partnership interest upon his retirement from the partnership on January 1,2015.The partnership financials on January 1,2015 are:

Assets

Equities

Equities

Required:

Required:

Prepare the journal entry to reflect Baskin's retirement from the partnership:

1.Assuming a bonus to Baskin.

2.Assuming a revaluation of total partnership capital based on excess payment.

3.Assuming goodwill equal to the excess payment is recorded.

Definitions:

Insider Trading

The unlawful act of conducting trades on the stock market for personal gain by exploiting privileged, non-public information.

Securities Exchange Act

A federal law governing the trading of securities, such as stocks and bonds, aimed at protecting investors and maintaining fair and orderly markets.

Misappropriate

The act of dishonestly or unfairly taking something, especially money, for one's own use.

Quarterly Sales Figures

Financial metrics reported by companies every three months, indicating the total revenue generated from sales within that period.

Q3: At the end of 2013,the partnership of

Q19: Creditor committees are elected<br>A)in all bankruptcy cases.<br>B)in

Q24: Debt service fund accounts for resources to

Q36: At December 31,2015 year-end,Lapwing Corporation's investment in

Q36: Forward contracts are very standardized and easily

Q36: No constructive gain or loss arises from

Q42: One characteristic of a derivative is it

Q50: Enterprise funds are accounted for in a

Q50: Cindy Lou's parents passed away while she

Q56: A "Bluebook" is substantial authority for purposes