Krull Corporation is preparing its interim financial statements for the third quarter of calendar 2014.

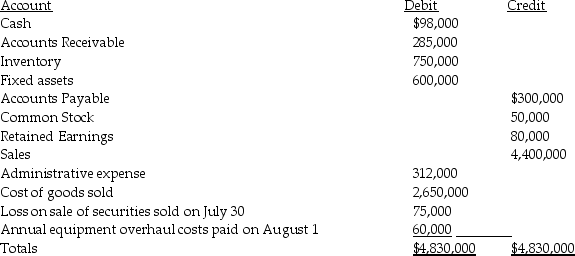

The following trial balance information is available for third quarter:

Additional information

Additional information

At the end of the year,Krull distributes annual employee bonuses and charitable donations that are estimated at $40,000,and $12,000,respectively.The cost of goods sold includes the liquidation of a $45,000 base layer in inventory that Krull will restore in the fourth quarter at a cost of $75,000.Effective corporate tax rate for 2014 is 32%.

Required:

Prepare Krull's interim income statement for the third quarter of calendar 2014.

Definitions:

Par Preferred Stock

Preferred stock with a nominal value assigned in the corporate charter, which determines the issue price and face value for dividend calculations.

Par Common Stock

The nominal or face value assigned to a share of common stock, as stated in the corporate charter.

Market Value

The immediate market value at which one can buy or sell an asset or service.

Dividend

A portion of a company's earnings that is distributed to shareholders, typically in the form of cash or additional stock, as a reward for investing in the company.

Q2: The parent affiliate recognizes a gain on

Q7: Under a partnership,each partner has mutual agency

Q8: Pew Corporation (a U.S.corporation)acquired all of the

Q14: A reconciliation between the segment data and

Q22: Plato Corporation,a U.S.company,purchases all of the outstanding

Q30: Under the entity theory,subsidiary assets and liabilities

Q40: At December 31,2014 year-end,Arnold Corporation's investment in

Q44: What partnership capital will Robert have after

Q46: When a new partner joins the partnership,the

Q48: A stock dividend by a subsidiary causes<br>A)the