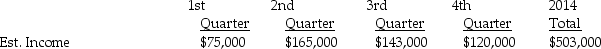

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2014,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2014.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2014.

Definitions:

Meperidine

A synthetic opioid analgesic medication used to treat moderate to severe pain, known commonly by its brand name, Demerol.

Hydromorphone

A potent opioid analgesic medication used to manage significant pain when other treatments are insufficient.

Furosemide

A diuretic medication used to treat fluid build-up due to heart failure, liver disease, or kidney disease by increasing urine production.

Duration of Action

The length of time the effects of a drug or medication last after reaching its peak action.

Q4: For 2014,consolidated net income will be what

Q9: Partnerships do not pay federal taxes but

Q13: A taxpayer must pay any tax deficiency

Q17: The research process should always begin with

Q24: Snodberry Catering has five operating segments,as summarized

Q31: Which of the following funds has similar

Q42: Static City started a department to provide

Q43: Plane Corporation,a U.S.company,owns 100% of Shipp Corporation,a

Q48: Avery died testate early in 2014.The following

Q61: Tax research involves which of the following