Use the following information to answer the question(s) below.

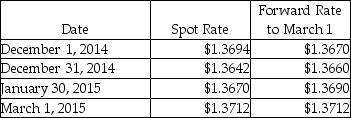

On December 1, 2014, Thomas Company, a U.S. corporation, purchases inventory from a vendor in Italy for 400,000 euros. Payment is due in 90 days. To hedge the transaction, Thomas signs a forward contract to buy 400,000 euros in 90 days at $1.3670. Thomas uses a discount rate of 6% (present value factor for 30 days = .9950; 60 days = .9901; 90 days = .9851) . Assume the forward contract will be settled net and this is a cash flow hedge. Currency exchange rates are shown below:

-What is the fair value of the forward contract at March 1?

Definitions:

TC Curve

A graphical representation showing the total cost of producing different quantities of a good or service.

TVC Curve

A graphical representation showing the relationship between a firm's total variable costs and its output level.

TFC

stands for Total Fixed Costs, which are the costs that do not vary with the level of production or sales, such as rent or salaries.

Average Fixed Cost

The fixed costs of production divided by the quantity of output produced, showing the cost of each unit's share of the fixed expenses.

Q1: When liquidating a partnership the first payment

Q15: Peking County incurred the following transactions during

Q19: Which one of the following statements is

Q19: Pecan Incorporated acquired 80% of the voting

Q21: Consider a sale of stock by a

Q26: The profit and loss sharing agreement for

Q26: Anthony Company declared and paid $20,000

Q35: Prepare journal entries to record the following

Q39: Hedge accounting is designed to record changes

Q50: Sabu is a 65%-owned subsidiary of Peerless.On