Use the following information to answer the question(s) below.

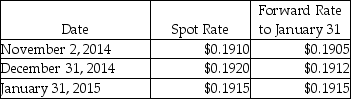

On November 2, 2014, Bellamy Corporation sells product to their Danish customer. At the same time, Bellamy signed a forward contract to sell 200,000 Danish krone in ninety days to hedge the account receivable at $0.1905, the 90-day forward rate. The receivable is expected to be collected in ninety days. Assume the forward contract will be settled net and this is a fair value hedge. The related exchange rates are shown below:

-Assuming a present value factor of 1 for simplicity,what is the fair value of this forward contract on December 31?

Definitions:

Q2: On December 5,2014,Unca Corporation,a U.S.firm,bought inventory items

Q5: If the price paid by a parent

Q10: Oscar Lloyd is serving as the executor

Q11: Required:<br>1.Prepare a schedule to allocate income or

Q13: Unrealized profits or losses on plant assets

Q19: Income is assigned to noncumulative,nonparticipating preferred stock

Q30: Noncontrolling interest share for 2013 was<br>A)$23,000.<br>B)$23,600.<br>C)$24,000.<br>D)$24,400.

Q31: Puddle Incorporated purchased an 80% interest in

Q36: The amount of noncontrolling interest share for

Q40: The four cash flow categories required in