Use the following information to answer the question(s) below.

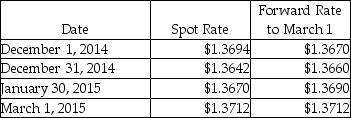

On December 1, 2014, Thomas Company, a U.S. corporation, purchases inventory from a vendor in Italy for 400,000 euros. Payment is due in 90 days. To hedge the transaction, Thomas signs a forward contract to buy 400,000 euros in 90 days at $1.3670. Thomas uses a discount rate of 6% (present value factor for 30 days = .9950; 60 days = .9901; 90 days = .9851) . Assume the forward contract will be settled net and this is a cash flow hedge. Currency exchange rates are shown below:

-What is the fair value of the forward contract at January 30?

Definitions:

Marginal Revenue

The additional income that a firm earns from selling one more unit of a good or service, critical for determining optimal production levels.

Total Profit

The total revenue of a business after subtracting all costs and expenses related to its operation.

Profit Per Unit

Profit per unit is the amount of money earned from selling one unit of a product or service, calculated by subtracting the cost per unit from the selling price per unit.

Break-even Point

The level of production at which total revenues equal total costs, resulting in neither profit nor loss.

Q2: At the time of a business acquisition,<br>A)identifiable

Q10: A cash distribution plan involves ranking the

Q11: At the beginning of 2014,Parling Food Services

Q11: At December 31,2013,the stockholders' equity of Pearson

Q29: The conventional approach for eliminating parent stock

Q30: Noncontrolling interest share for 2013 was<br>A)$23,000.<br>B)$23,600.<br>C)$24,000.<br>D)$24,400.

Q36: An enterprise has eight reporting segments.Five segments

Q38: For each of the 12 accounts listed

Q46: Which of the following statements about variable

Q49: An elimination entry at December 31,2014 for