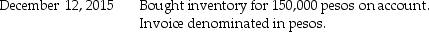

Johnson Corporation (a U.S.company)began operations on December 1,2015,when the owner contributed $100,000 of his own money to establish the business.Johnson then had the following import and export transactions with unaffiliated Mexican companies:

Janury 15,2016 Collected the 120,001 pesos from the Mexican customer and immediately converted them into U. S dollars. The following exchange rates apply:

Janury 15,2016 Collected the 120,001 pesos from the Mexican customer and immediately converted them into U. S dollars. The following exchange rates apply:

Required:

1.What were Sales in the income statement for the year ended December 31,2015?

2.What was the COGS associated with these sales?

3.What is the Accounts Payable balance in the balance sheet at December 31,2015?

4.What is the Inventory balance in the balance sheet at December 31,2015?

Definitions:

Inferences

Deductions or conclusions drawn from evidence and reasoning rather than from explicit statements.

Feasibility Section

A part of a plan or proposal that evaluates the practicality and possibility to implement the project or solution successfully.

Allotted Time

A specific duration designated for a particular task or activity.

Solution

A means of solving a problem or dealing with a challenging situation.

Q1: When liquidating a partnership the first payment

Q9: Partnerships do not pay federal taxes but

Q14: On January 1,2014,Singh Company acquired an

Q16: Proman Manufacturing owns a 90% interest in

Q21: If a sale on account by a

Q24: The equation,in a set of simultaneous equations,that

Q28: Opie Industries is a manufacturer of plastic

Q36: Flagship Company has the following information collected

Q36: When total debts exceed the fair value

Q41: The acquisitions method for consolidation requires that