Use the following information to answer the question(s) below.

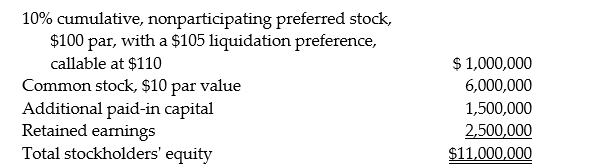

On January 1, 2014, Pardy Corporation acquired a 70% interest in the common stock of Salter Corporation for $7,000,000 when Salter's stockholders' equity was as follows: There were no preferred dividends in arrears on January 1, 2014. There are no book value/fair value differentials.

There were no preferred dividends in arrears on January 1, 2014. There are no book value/fair value differentials.

-Assume Salter's net income for 2014 is $220,000.No dividends are declared or paid in 2014.What is the change in Pardy's Investment in Salter for the year ending December 31,2014?

Definitions:

Non-interest-bearing

A financial term describing a debt or loan that does not accrue interest over time.

Simple Interest

A method of calculating the interest charge on a loan based on the original principal balance and not on accumulated interest.

T-bill

A short-term government security with maturity periods ranging from a few days to 52 weeks.

Prevailing Yield

The current return rate on an investment, typically referring to bonds or other fixed-income securities.

Q2: Sandpiper Corporation paid $120,000 for annual property

Q7: The balance sheet of the Addy,Bess,and Clara

Q9: Ackroyd's noncontrolling interest share for 2014 is<br>A)$7,609.<br>B)$8,044.<br>C)$15,652.<br>D)$23,696.

Q9: Joint ventures may be organized as partnerships

Q15: On January 2,2013 Piron Corporation issued 100,000

Q24: Salter has a 2014 net loss of

Q32: Piel Corporation (a U.S.company)began operations on January

Q42: The governmental fund accounting equation is Current

Q44: The GAAP requires a noncontrolling interest in

Q51: Pinkerton Inc.owns 10% of Sable Company.In the