Olson Corporation paid $62,000 to acquire 100% of Towing Corporation's outstanding voting common stock at book value on May 1,2013.The stockholders' equity of Towing on January 1,2013 consisted of $40,000 Capital Stock and $20,000 Retained Earnings.Towing's total dividends for 2013 were $6,000,paid equally on April 1 and October 1.Towing's net income was earned uniformly throughout 2013.In 2013,preacquisition sales were $10,000 and preacquisition expenses were cost of sales for $5,000.(There were no other preacquisition expenses in 2013.)

During 2013,Olson made sales of $10,000 to Towing at a gross profit of $3,000.One-half of this merchandise was inventoried by Towing at year-end,and one-half of the 2011 intercompany sales were unpaid at year-end 2013.

Olson sold equipment with a ten-year remaining useful life to Towing at a $2,000 gain on December 31,2013.The straight-line depreciation method is used by both companies.The equipment has no salvage value.

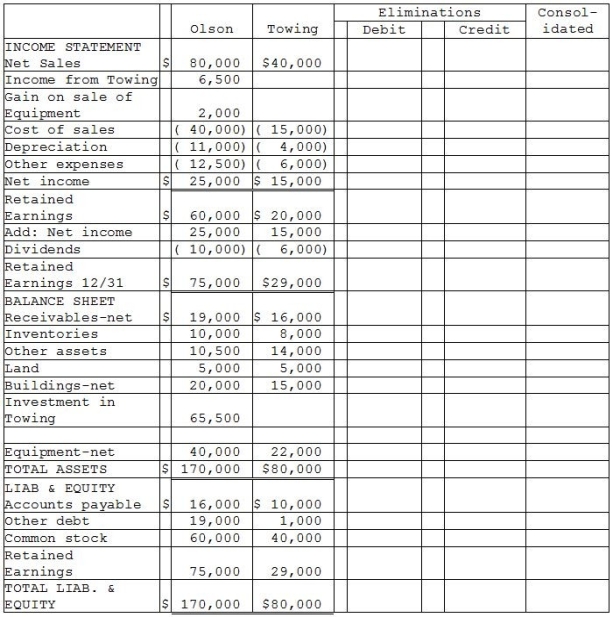

Financial statements of Olson and Towing Corporations for 2013 appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidating working papers for Olson Corporation and Subsidiary for the year ending December 31,2013.

Definitions:

Q2: Insurance companies invest primarily in:<br>A) CMOs<br>B) commercial

Q8: Padma Corporation owns 70% of the outstanding

Q25: 20-24.A condition for a REIT to be

Q30: On January 1,2014,Packaging International purchased 90% of

Q30: Under the entity theory,subsidiary assets and liabilities

Q34: For 2012,2013,and 2014,Squid Corporation earned net incomes

Q42: On September 1,2013,Beck Corporation acquired an 80%

Q47: 18-43.Release provisions written into ADC loans are

Q47: The common characteristic of derivatives is the

Q48: Peel Corporation acquired an 80% interest in