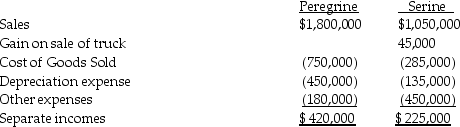

Peregrine Corporation acquired an 80% interest in Serine Corporation in 2011 at a time when Serine's book values and fair values were equal to one another.On January 1,2014,Serine sold a truck with a $55,000 book value to Peregrine for $100,000.Peregrine is depreciating the truck over 10 years using the straight-line method.The truck has no salvage value.Separate incomes for Peregrine and Serine for 2014 were as follows:  Peregrine's investment income from Serine for 2014 was

Peregrine's investment income from Serine for 2014 was

Definitions:

Synaptic Cleft

The small gap at a synapse between two neurons, where neurotransmitters are released to transmit signals from one neuron to another.

Chloride Ions

Negatively charged ions (Cl-) that play key roles in bodily functions such as maintaining fluid balance and transmitting nerve impulses.

Prolactin

A hormone produced by the pituitary gland involved in milk production, reproductive functions, and immune system regulation.

Gray Matter

The grayish neurons and neural segments that are involved in spinal reflexes.

Q2: The law excludes from the category of

Q5: Pierce Manufacturing owns all of the outstanding

Q18: The main disadvantage of the S-corporation form

Q23: On January 2,2014,Paleon Packaging purchased 90% of

Q24: GAAP (ASC 810-10-65)states that an acquirer purchases

Q26: 18-38.Instead of buying land outright developers may

Q27: Parkview Holdings owns 70% of Skyline Corporation.On

Q45: A disadvantage of filing a consolidated return

Q47: 18-43.Release provisions written into ADC loans are

Q47: Which method of accounting will generally be