Use the following information to answer the question(s) below.

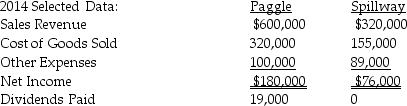

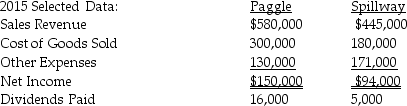

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

-If the sale referred to above was a downstream sale,the total sales revenue reported in the consolidated income statement for 2014 would be

Definitions:

Transcranial Magnetic Stimulation

A non-invasive procedure that uses magnetic fields to stimulate nerve cells in the brain to treat depression and other conditions.

Deep Brain Stimulation

A neurosurgical procedure aimed at treating neurological and psychiatric conditions by implanting electrodes in specific areas of the brain to send electrical impulses.

Lesioning Techniques

Methods used in neuroscience to study the brain by intentionally damaging specific areas to observe behavioral effects.

Positron Emission Tomography

A diagnostic imaging technique that uses radioactive substances to visualize and measure changes in metabolic processes, and in other physiological activities including blood flow, regional chemical composition, and absorption.

Q14: On January 1,2014,Singh Company acquired an

Q14: A reconciliation between the segment data and

Q21: Under the acquisition method a combination is

Q23: Land loans will seldom exceed:<br>A) 70-80% of

Q25: 12-38.Which one of these conditions involves the

Q29: 20-15.A REIT can NOT sell a property

Q31: 12-23.The most significant job classification relating to

Q35: 12-14.Borrower qualifications are mostly the concern of

Q37: If the sale referred to above was

Q45: The consolidated cash flow statement is prepared