Use the following information to answer the question(s) below..

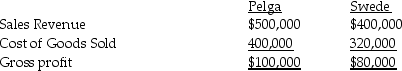

Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows:

-Consolidated cost of goods sold for Pelga and Subsidiary for 2015 were

Definitions:

Average Cost Curve

A graphical representation that shows the cost per unit of output at different levels of production.

Marginal Cost

The extra expense associated with manufacturing an additional unit of a good or service.

Cost of Capital

The rate of return that a company must earn on its investment projects to maintain its market value and attract funds, including the cost of debt and equity financing.

Market Supply

The total amount of goods or services that are available for purchase within a specific market at a given time.

Q5: Jabiru Corporation purchased a 20% interest in

Q10: Parker Corporation owns an 80% interest in

Q16: The purchase price of an option contract

Q20: Paco Corporation owns 90% of Aber Corporation,Aber

Q24: On January 1,2014,Psalm Corporation purchased all the

Q30: For upstream sales the total amount of

Q36: All of the following factors would be

Q40: When a company issues bonds,the bond liability

Q42: A parent company uses the equity method

Q44: The GAAP defines the accounting concept of