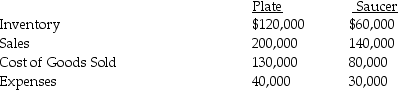

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31,2014.Plate has owned 70% of Saucer for the past five years,and at the time of purchase,the book value of Saucer's assets and liabilities equaled the fair value.The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets.At the time of purchase,the fair values and book values of Saucer's assets and liabilities were equal.

In 2013,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2013,but was sold in 2014.In 2014,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2014.

In 2013,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2013,but was sold in 2014.In 2014,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2014.

Required: Calculate following balances at December 31,2014.

a.Consolidated Sales

b.Consolidated Cost of goods sold

c.Consolidated Expenses

d.Noncontrolling interest share of Saucer's net income

e.Consolidated Inventory

Definitions:

Psychosomatic

Pertaining to physical symptoms that are caused or significantly influenced by emotional factors.

Generalized Anxiety Disorder

A mental health disorder characterized by persistent and excessive worry about various aspects of life, often imagining worst-case scenarios.

Apprehensive

Feeling anxious or fearful about the future or something in particular.

Conversion Disorder

A psychiatric disorder where psychological stress manifests as physical symptoms without a medical cause.

Q2: When performing a consolidation,if the balance sheet

Q4: Factors that affect the value of tax

Q6: A U.S.firm has a Belgian subsidiary that

Q11: Which method must be used if ASC

Q15: Paradise Corporation owns 100% of Aldred Corporation,90%

Q18: 13-41.Mortgage bankers receive income from: I.marketing rate

Q20: Stripe Corporation,a British subsidiary of Polka

Q22: With respect to the bond purchase,the consolidated

Q34: Under parent company theory,noncontrolling interest is valued

Q44: Which one of the following will increase