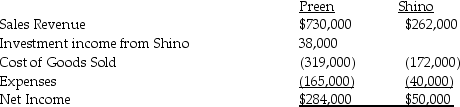

Preen Corporation acquired a 60% interest in Shino Corporation at a cost equal to 60% of the book value of Shino's net assets in 2014.At the time of acquisition,the book value and fair value of Shino's assets and liabilities were equal.During 2015,Preen sold $120,000 of merchandise to Shino.All intercompany sales are made at 150% of Preen's cost.Shino's beginning and ending inventories resulting from intercompany sales for 2015 were $60,000 and $36,000,respectively.Income statement information for both companies for 2015 is as follows:

Required:

Required:

Prepare a consolidated income statement for Preen Corporation and Subsidiary for 2015.

Definitions:

LLLP

A limited liability limited partnership, a type of partnership where some partners have limited liability (similar to limited partners in an LP) while also having the ability to participate in management.

General Partner

A general partner is an owner of a partnership who has unlimited liability and is typically involved in the day-to-day management of the business.

Share of Profit

An individual's or entity's portion of the net profits derived from a business venture, investment, or partnership.

Conversion

The wrongful act of taking or using someone else's property without permission, treating it as if it were one's own.

Q12: Under the temporal method monetary assets and

Q16: If a U.S.company wants to hedge a

Q18: Tillman Fabrications has five operating segments,as summarized

Q23: The excess of fair value over book

Q26: 18-38.Instead of buying land outright developers may

Q38: Page Corporation acquired a 60% interest in

Q41: Powell Corporation acquired 90% of the voting

Q48: The gain from the bond purchase that

Q49: On November 1,2014,Portsmith Corporation,a calendar-year U.S.corporation,invested in

Q50: Meric Corporation (a U.S.company)began operations on