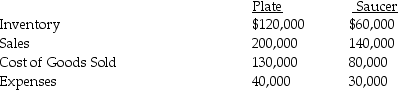

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31,2014.Plate has owned 70% of Saucer for the past five years,and at the time of purchase,the book value of Saucer's assets and liabilities equaled the fair value.The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets.At the time of purchase,the fair values and book values of Saucer's assets and liabilities were equal.

In 2013,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2013,but was sold in 2014.In 2014,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2014.

In 2013,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2013,but was sold in 2014.In 2014,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2014.

Required: Calculate following balances at December 31,2014.

a.Consolidated Sales

b.Consolidated Cost of goods sold

c.Consolidated Expenses

d.Noncontrolling interest share of Saucer's net income

e.Consolidated Inventory

Definitions:

Loudness of Sounds

The loudness of sounds is a subjective measure of sound intensity perceived by the human ear, which depends on the amplitude of sound waves and is measured in decibels.

Hair Cell Responses

The activation of hair cells in the inner ear, which play a crucial role in converting sound vibrations into electrical signals for the brain to interpret.

Activated Hair Cells

Sensory cells located in the inner ear that convert mechanical vibrations from sound waves into electrical signals to be sent to the brain.

Biopsychosocial Approach

A comprehensive model that explains the complex interplay between biological, psychological, and socio-environmental factors in human health and illness.

Q4: The entity theory approach to consolidated statements

Q8: 18-14.In the case of seller financing,after the

Q9: 20-12.REITs that invest in both equity properties

Q12: Under parent company theory,noncontrolling interest is classified

Q18: The GAAP requires that all majority-owned subsidiaries

Q40: Which one of the following statements is

Q41: If an acquisition by a parent of

Q45: Paglia Corporation owns 80% of Aburn Corporation

Q49: Samford Corporation's stockholders' equity on December 31,2014

Q49: An elimination entry at December 31,2014 for