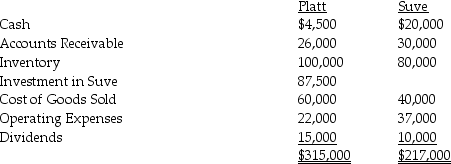

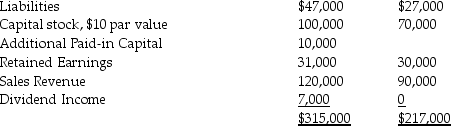

Platt Corporation paid $87,500 for a 70% interest in Suve Corporation on January 1,2014,when Suve's Capital Stock was $70,000 and its Retained Earnings $30,000.The fair values of Suve's identifiable assets and liabilities were the same as the recorded book values on the acquisition date.Trial balances at the end of the year on December 31,2014 are given below:

During 2014,Platt made only two journal entries with respect to its investment in Suve.On January 1,2014,it debited the Investment in Suve account for $87,500 and on November 1,2014,it credited Dividend Income for $7,000.

During 2014,Platt made only two journal entries with respect to its investment in Suve.On January 1,2014,it debited the Investment in Suve account for $87,500 and on November 1,2014,it credited Dividend Income for $7,000.

Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Platt and Subsidiary for the year ended December 31,2014.

2.Prepare a consolidated balance sheet for Platt and Subsidiary as of December 31,2014.

Definitions:

Ethical Way

A manner of conducting actions and making decisions that align with moral principles and values, ensuring fairness, integrity, and respect.

Highest Quality

Highest Quality signifies products, services, or processes that meet or exceed established standards of excellence, often differentiated by superior materials, craftsmanship, or performance attributes.

Sustainable Consumer Behavior

Shopping and consumption habits that are mindful of environmental impact, aiming to minimize waste and reduce carbon footprint.

Lack of Knowledge

A deficiency in understanding, awareness, or information in a particular area or subject.

Q8: Assume that Penguin sold the additional 3,000

Q13: Plover Corporation acquired 80% of Sink Inc.equity

Q26: 13-12.Besides physical characteristics,the review appraiser examines:<br>A) location<br>B)

Q31: 18-15.Payments made to municipalities or other local

Q36: The amount of noncontrolling interest share for

Q41: Unrealized gains and losses are to be

Q42: A subsidiary's realized income is its reported

Q46: The conventional approach is appropriate for recording

Q48: All companies holding a significant interest in

Q49: Parrot Corporation acquired 90% of Swallow Co.on