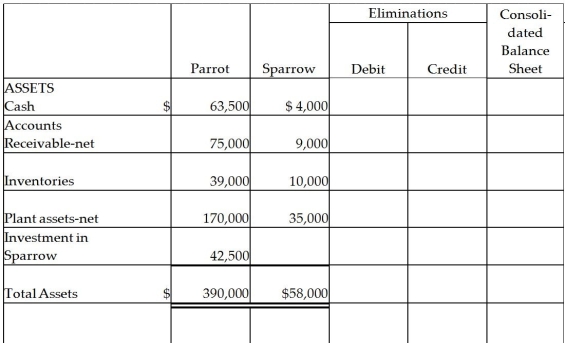

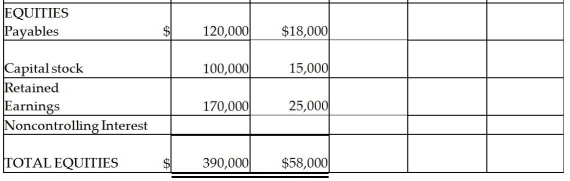

Parrot Inc.acquired an 85% interest in Sparrow Corporation on January 2,2014 for $42,500 cash when Sparrow had Capital Stock of $15,000 and Retained Earnings of $25,000.Sparrow's assets and liabilities had book values equal to their fair values except for inventory that was undervalued by $2,000.Balance sheets for Parrot and Sparrow on January 2,2014,immediately after the business combination,are presented in the first two columns of the consolidated balance sheet working papers.

Required:

Required:

Complete the consolidation balance sheet working papers for Parrot and subsidiary at January 1,2014.

Definitions:

Journalize

The process of recording transactions in a company's journal, documenting the details of financial transactions and their effects on the accounts.

Office Supplies

Consumable items used in an office environment for daily operations, such as paper, pens, and staplers.

Paid Cash

The action of disbursing money to settle a transaction or obligation.

Placed on Account

A term referring to a transaction being recorded on a company's books under an account receivable or payable, typically indicating a credit sale or purchase.

Q2: Insurance companies invest primarily in:<br>A) CMOs<br>B) commercial

Q4: Consider a person with a house valued

Q6: 21-14.The capital asset pricing model (CAPM)indicates:<br>A) the

Q8: 16-15.The following will negatively affect real estate

Q9: Ackroyd's noncontrolling interest share for 2014 is<br>A)$7,609.<br>B)$8,044.<br>C)$15,652.<br>D)$23,696.

Q18: Under Federal Regulation Q,the individual states were

Q19: Pecan Incorporated acquired 80% of the voting

Q22: 20-17.To qualify for REIT status it must

Q27: Assume the parent company theory is used.On

Q49: Parrot Corporation acquired 90% of Swallow Co.on