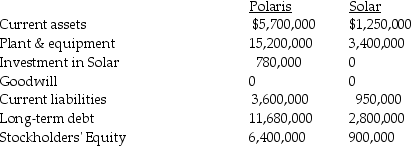

Polaris Incorporated purchased 80% of The Solar Company on January 2,2014,when Solar's book value was $800,000.Polaris paid $700,000 for their acquisition,and the fair value of noncontrolling interest was $175,000.At the date of acquisition,the fair value and book value of Solar's identifiable assets and liabilities were equal.At the end of the year,the separate companies reported the following balances:

Requirement 1: Calculate consolidated balances for each of the accounts as of December 31,2014.

Requirement 1: Calculate consolidated balances for each of the accounts as of December 31,2014.

Requirement 2: Assuming that Solar has paid no dividends during the year,what is the ending balance of the noncontrolling interest in the subsidiary?

Definitions:

Predetermined Overhead Rate

The rate used to allocate manufacturing overhead to products, calculated before the period begins based on estimated costs and activity levels.

Direct Labor-Hours

A measure used in accounting to allocate costs, referring to the total hours worked by employees directly involved in the manufacturing process.

Job-Order Costing System

A cost accounting system that accumulates costs incurred according to each job or project, suitable for industries where goods or services are produced on a custom basis.

Predetermined Overhead Rate

is calculated before a period begins and is used to allocate manufacturing overhead costs to products based on a chosen activity basis, such as labor hours or machine hours.

Q1: On January 1,2014,Paisley Incorporated paid $300,000 for

Q2: If a broker makes a statement that

Q3: 20-16.An IRS code criteria for a REIT

Q6: Lincoln Corporation,a U.S.manufacturer,both imports needed materials

Q6: A parent company acquired 100% of the

Q11: The main determinants of the form of

Q22: Johnson Corporation (a U.S.company)began operations on

Q37: A promissory note should be:<br>A) sold without

Q44: Which one of the following will increase

Q48: Saito Corporation's stockholders' equity on December 31,2014