Use the following information to answer the question(s) below.

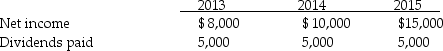

On January 1, 2013, Pansy Company acquired a 10% interest in Sunflower Corporation for $80,000 when Sunflower's stockholders' equity consisted of $400,000 capital stock and $100,000 retained earnings. Book values of Sunflower's net assets equaled their fair values on this date. Sunflower's net income and dividends for 2013 through 2015 were as follows:

-Assume that Pansy Incorporated used the cost method of accounting for its investment in Sunflower.The balance in the Investment in Sunflower account at December 31,2015 was

Definitions:

Primarily Personal

Indicates the use of property or resource predominantly for the owner's personal purposes and enjoyment rather than for business or rental.

Personal/Rental

Relates to property used for both personal and rental purposes, requiring specific tax treatment and allocation of expenses for each use.

Allocate Expenses

The process of assigning costs to specific cost centers or accounts based on their usage or benefit received.

Royalties

Payments made to the owners of intellectual property, such as patents, copyrights, and trademarks, usually based on a percentage of revenue generated from their use.

Q1: In the preparation of consolidated financial statements,which

Q3: Controlling interest share of consolidated net income

Q6: 12-16.A borrower is considered self employed if

Q7: Wader's Corporation paid $120,000 for a 25%

Q8: Assume that Penguin sold the additional 3,000

Q10: "Points" are defined as:<br>A) a fee charged

Q14: The first step in recording an acquisition

Q18: On January 1,2013,Starling Corporation held an 80%

Q38: An investor uses the cost method of

Q43: Pony acquired Spur Corporation's assets and liabilities