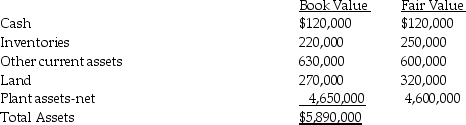

Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31,2013.Parrot borrowed $2,000,000 to complete this transaction,in addition to the $640,000 cash that they paid directly.The fair value and book value of Sparrow's recorded assets and liabilities as of the date of acquisition are listed below.In addition,Sparrow had a patent that had a fair value of $50,000.

Required:

Required:

1.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow survives as a separate legal entity.

2.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow will dissolve as a separate legal entity.

Definitions:

Par Value

The face value of a bond or stock as stated by the issuing company, which bears no correlation to its market value.

Bond Interest Expense

The amount of interest a company must pay periodically to holders of its bonds, as per the interest rate specified in the bond agreement.

Bond Liability

An obligation or debt issued by a company, promising to repay the principal amount along with interest to bondholders at a specified future date.

Q5: In the absence of inflationary expectation,the _

Q10: 20-22.Partnerships can be categorized as:<br>A) general<br>B) limited<br>C)

Q14: Push-down accounting is the process of recording

Q19: 18-24.The purpose of an option is:<br>A) to

Q20: 18-20.Construction loan provisions:<br>A) ensure the availability of

Q20: The method based on the premise that

Q23: 12-10.The following lien takes first place on

Q36: A bargain purchase gain is recorded as

Q43: Pony acquired Spur Corporation's assets and liabilities

Q50: Sabu is a 65%-owned subsidiary of Peerless.On