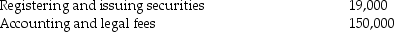

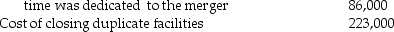

Pali Corporation exchanges 200,000 shares of newly issued $10 par value common stock with a fair market value of $40 per share for all the outstanding $5 par value common stock of Shingle Incorporated,which continues on as a legal entity.Fair value approximated book value for all assets and liabilities of Shingle.Pali paid the following costs and expenses related to the business combination:

Salaries of Pali's employees whose

Salaries of Pali's employees whose

Required: Prepare the journal entries relating to the above acquisition and payments incurred by Pali,assuming all costs were paid in cash.

Required: Prepare the journal entries relating to the above acquisition and payments incurred by Pali,assuming all costs were paid in cash.

Definitions:

Outstanding

Refers to shares that are currently owned by investors, including public shareholders, company officials, and insiders.

Earnings Per Share

A financial metric that calculates the portion of a company's profit allocated to each outstanding share of common stock, serving as an indicator of a company's profitability.

Stock Dividend

A distribution of additional shares of a company's stock to its shareholders without any change in ownership percentage.

Stock Split

A corporate action where a company divides its existing shares into multiple shares to boost the liquidity of the shares, although the overall value of the company does not change.

Q2: Monitoring costs do NOT include:<br>A) auditing the

Q2: Risk:<br>A) is the same as risk-return tradeoff<br>B)

Q8: Which of the following methods has the

Q14: If an investor sells a portion of

Q14: 16-17.Presently the tax laws that favor investment

Q19: 12-19.The theories that explain default risk include:<br>A)

Q23: On January 1,2014,Jeff Company acquired a

Q30: 10-19.Mortgage-related securities that promise payments similar to

Q33: The GAAP only authorizes the use of

Q39: An entry is necessary to eliminate the