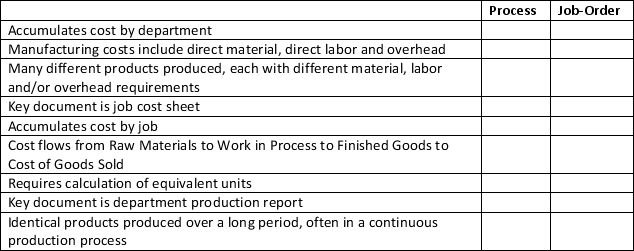

Identify which costing method is described in the statements below by marking an "X" in the appropriate column some items may apply to both.

Definitions:

Lease Payments

Regular payments made by a lessee to a lessor for the use of some asset.

After-Tax Lease Payment

The lease payment amount minus any tax savings resulting from deductible lease expenses.

Tax Rate

The rate at which a person or business is taxed on their earnings or profits.

Borrowed Funds

Money that is borrowed from banks or other lenders that must be repaid, often with interest, according to agreed upon terms.

Q6: The measure that divides customer net profit

Q11: 12-11.According to Jackson and Kaserman:<br>A) the ability-to-pay

Q14: 11-12.For premium passthrough securities,which of the following

Q23: The customer net profit shows managers how

Q25: A costing system where all product costs

Q30: Which of the following is

Q34: 10-29.Investors are attracted to pass-through securities because:<br>A)

Q37: A promissory note should be:<br>A) sold without

Q123: Using the direct method of preparing the

Q163: Midland Industries is the manufacturer of metal-frame