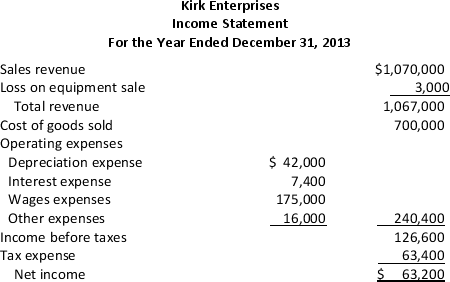

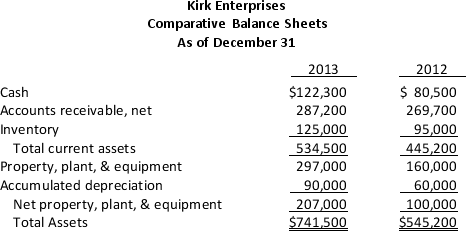

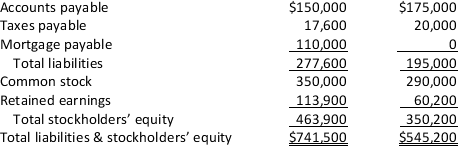

Wil Wheaton,Kirk Enterprises' controller,is preparing the financial statements for 2013.He has completed the comparative balance sheets and income statement,which follow,and has gathered this additional information:

On December 31,2013,Kirk sold a piece of equipment with an original cost of $25,000 for $10,000 cash.The equipment had a book value of $13,000.

On February 1,2013,Kirk issued $60,000 of common stock to raise cash in anticipation of the purchase of a new building later in the year.

On February 2,2013,Kirk took out a ten-year $110,000 long-term loan to provide the remaining funds needed to purchase the building.

On May 15,2013,Kirk paid $162,000 for the new building.

The company paid a cash dividend of $9,500.

Required:

Using the indirect method, prepare Kirk Enterprises’ statement of cash flows for 2013.

Definitions:

Xiphoid Process

A small cartilaginous projection at the lower end of the sternum, which becomes bony in older adults.

Sternal Body

The main, long part of the sternum (breastbone) to which the rib cartilage attaches.

Vendors

Entities or individuals that sell products or services, playing a crucial role in business supply chains and procurement processes.

QBO

QuickBooks Online (QBO) is a cloud-based financial management software designed for small to medium-sized businesses to handle accounting tasks online.

Q4: Assumable loans and carry backs:<br>A) have totally

Q8: For the economy the concept that the

Q11: With an index rate of 8.5%,a 200

Q23: A reason not to refinance a loan

Q108: M & M Manufacturing has provided the

Q123: A profit center manager's performance is typically

Q130: Which of the following is a use

Q134: In preparing a common-size income statement,you express

Q137: The quality of assets is assessed through

Q190: The formula for calculating ROI is<br>A)Segment margin