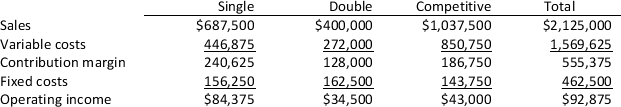

Gary Brown Manufacturing makes single kayaks,double kayaks,and lightweight competitive kayaks.The double kayak line has been showing losses for several years,and management is considering dropping the line.Recent income statements have been very similar to the following information which was prepared for the most recent year:

Of the fixed costs,$393,750 is common costs that have been allocated equally to each product line.What will total operating income be if Brown drops the double kayak line?

Of the fixed costs,$393,750 is common costs that have been allocated equally to each product line.What will total operating income be if Brown drops the double kayak line?

Definitions:

Deferral Method

An accounting technique that involves delaying the recognition of income or expenses until a later accounting period.

Unrestricted Contributions

Donations that can be used by the recipient for any purpose, without any constraints or designated restrictions by the donor.

NFP Accounting

Accounting practices specific to Not-For-Profit organizations, focusing on fund accounting, donor restrictions, and reporting financial performance in a manner distinct from profit-oriented businesses.

Capitalize

The act of recording a cost or expense on the balance sheet for purposes of delaying full recognition of the expense over time through depreciation or amortization.

Q30: Which of the following is

Q34: Culver,Inc.manufactures motors used in electric toothbrushes and

Q46: Which of the following is not used

Q60: When a company continues to manufacture a

Q90: A disadvantage of decentralization is that<br>A)If lower-level

Q92: Cleopatra Corporation's Lingerie division has a segment

Q103: Which of the following employees is typically

Q115: Paris Manufacturing Company Inc. uses 400 units

Q148: Which of the following would

Q155: Johnston Manufacturing Company purchased 14,000 switches to