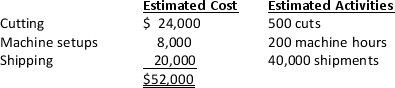

Clover Manufacturing Company makes two products. The company’s budget includes $200,000 of overhead. Using the traditional allocation method, the company has allocated overhead based on estimated total direct labor cost of $125,000. Clover recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: cutting, machine setups, and good shipped. The following is a summary of company information:

a.Calculate the company's overhead rate as a percentage of direct labor cost.

b.Calculate the company's overhead rates using the activity-based costing pools.

Definitions:

Lease Rate

The amount charged under a lease agreement for the use of an asset, often expressed as a payment amount per period.

Sales-Type Capital Lease

A leasing agreement in which the lessor recognizes immediate sales revenue and profit, reflecting the transaction as a sale rather than a rental.

Operating Lease

A lease agreement allowing the use of an asset but does not convey rights similar to ownership of the asset.

Direct Financing Capital Lease

A lease agreement where the lessor purchases an asset and leases it out to the lessee, earning interest revenue over the lease term.

Q22: Which of the following is

Q27: In setting the direct labor quantity standard,allowances

Q40: Saguaro Company is a leading producer of

Q69: When a company purchases materials for use

Q80: Betty Hopper,controller for Diamond Manufacturing Company,has prepared

Q86: When direct materials are used,which of the

Q133: Martin,Inc.is preparing a direct labor budget

Q142: The direct labor efficiency variance is that

Q158: When multiple products share a constrained resource,the

Q182: If a company uses more direct labor