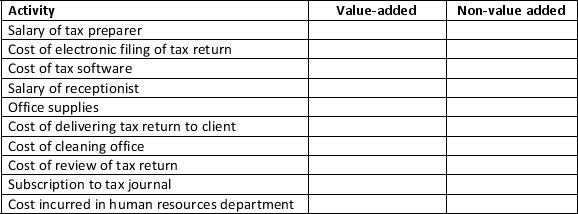

The following list includes activities that are performed in a CPA firm..Classify each activity as value-added or non-value added.

Definitions:

Contribution Format

A type of income statement that separates variable costs from fixed costs to calculate a company's contribution margin.

Absorption Costing

A costing method that includes all manufacturing costs—direct materials, direct labor, and both variable and fixed manufacturing overhead—in the cost of a product.

Variable Costing

A ledger maintaining technique that factors in only the variable costs incurred during production (direct materials, direct labor, and variable manufacturing overhead) into product pricing.

Absorption Costing

In this financial accounting strategy, the entirety of manufacturing expenses—encompassing direct materials, direct labor, and both variable and fixed overheads—are captured in the cost of a product.

Q16: One of your managers has requested the

Q58: In an activity-based costing system, after the

Q79: Assume you have been assigned to a

Q85: The payback period and the accounting rate

Q87: To determine the present value of

Q94: The process of using activity-based costing information

Q146: When a variable overhead spending variance is

Q169: The key to reducing costs through activity

Q181: Simple Styles is a dress manufacturer.The company

Q187: Sunk cost are classified as<br>A)Irrelevant.<br>B)Avoidable.<br>C)Opport<br>D)None of these