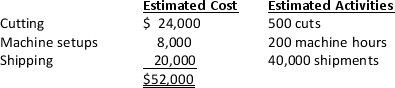

Clover Manufacturing Company makes two products. The company’s budget includes $200,000 of overhead. Using the traditional allocation method, the company has allocated overhead based on estimated total direct labor cost of $125,000. Clover recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: cutting, machine setups, and good shipped. The following is a summary of company information:

a.Calculate the company's overhead rate as a percentage of direct labor cost.

b.Calculate the company's overhead rates using the activity-based costing pools.

Definitions:

Accounts Receivable

Amounts owed to a company by customers for goods or services that have been delivered or used but not yet paid for.

Prepaid Expenses

Expenses paid in advance for goods or services, which are recognized as assets until they are consumed or the term of use expires.

Bonds Issued

Long-term securities issued by corporations or governments to raise capital, with a promise to pay back with interest.

Financing Activities

Transactions that result in changes in the size and composition of the equity capital or borrowings of a company.

Q11: Which of the following is not a

Q15: The finished goods inventory account records the

Q24: Which of the following is

Q48: Which of the following is

Q57: The most popular way to begin the

Q99: In the activity identification stage of implementing

Q107: Indirect materials are classified as manufacturing overhead.How

Q145: Which of the following is

Q154: Adler Industries uses a standard cost system.

Q181: A material variance is one that is