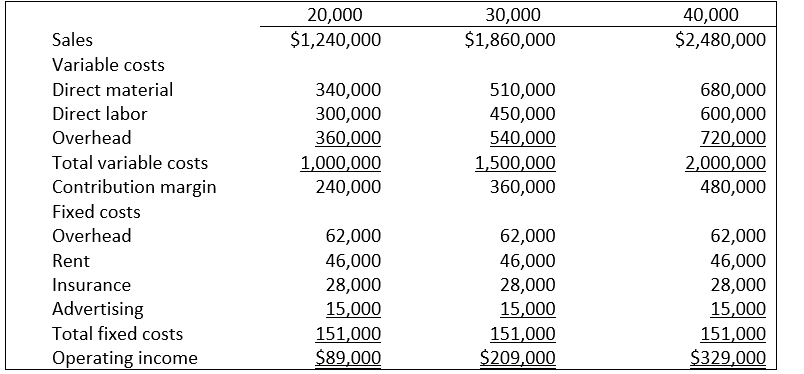

Kevin Jarvis is the controller of Bitterroot Industries.Kevin prepared the following budgeted income statement at various levels of sales.After careful review of the budgeted income statements,and after discussions with the sales and production managers,the CEO determines that the best alternative is to base the budget on a sales volume of 30,000 units.

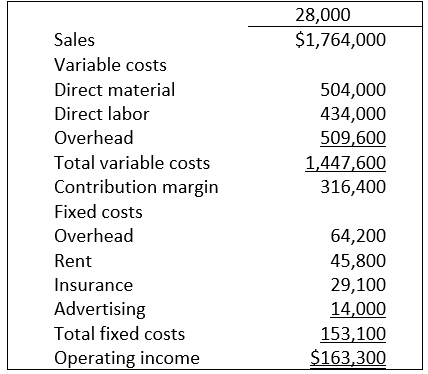

Actual results for the year were 28,000 units, reflected in the following income statement:

What is the flexible budget variance for direct material?

Definitions:

Q22: Grantham Manufacturing Company makes oak rocking chairs.Budgeted

Q36: Gough's Manufacturing had underapplied overhead totaling $5,000

Q52: Your company has realized that some managers

Q63: Tanger Products plans to produce 10,000<br>A) $2<br>B)

Q64: The key to reducing costs through activity

Q71: Which of the following would be considered

Q78: Indicators that an activity-based costing analysis

Q88: Calculating the activity rate is similar to

Q110: As non-value-added activities and their associated resources

Q189: To determine the cash payments for direct