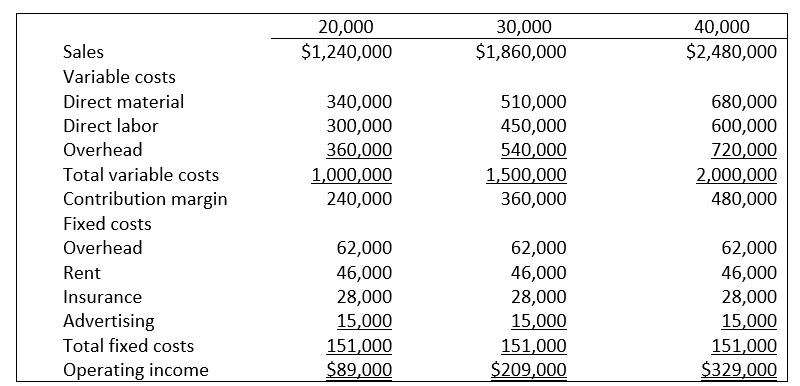

Kevin Jarvis is the controller of Bitterroot Industries.Kevin prepared the following budgeted income statement at various levels of sales.After careful review of the budgeted income statements,and after discussions with the sales and production managers,the CEO determines that the best alternative is to base the budget on a sales volume of 30,000 units.

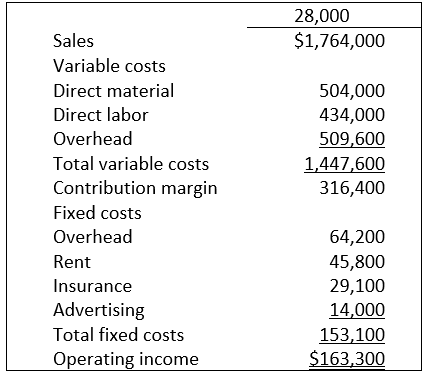

Actual results for the year were 28,000 units, reflected in the following income statement:

What is the sales volume variance for direct labor?

Definitions:

Money Distribution

The process of disbursing or allocating financial resources, often by a corporation or governmental entity.

Partnership Liability

The financial obligations or debts for which a partnership is responsible, which can affect the partners' individual tax situations.

Partnership Interest

An ownership share in a partnership, representing a partner's stake in the assets and operations of the business.

Ordinary Income

Income earned through wages, salaries, commissions, and interest, which is taxed at standard federal income tax rates.

Q5: A type of analysis that helps decision

Q15: The finished goods inventory account records the

Q18: According to the theory of constraints,which of

Q36: Haygood,Inc.is a manufacturer of cast iron fire

Q48: The algebraic equation for the direct materials

Q58: In an activity-based costing system, after the

Q126: Danny's Delights is a wholesale bakery.Danny makes

Q151: Accepting special orders may produce additional revenues,but

Q158: Using the payback method to evaluate capital

Q164: If practical standards are used,the standard quantity