Percy's Pickled Snacks produces several types of pickled vegetables.The company budgets for each quarter in the last month of the previous quarter.In early March,Percy is preparing the budget for pickled beets.Budgeted sales are 12,000 jars for April,16,000 jars for May,and 19,000 jars for June.Each jar requires 1.2 pounds of beets.The pickling process takes 60 minutes for 20 jars.Because pressurized cooking is used,the processing is monitored by an employee at all times.Each jar of pickled beets sells for $15.00.

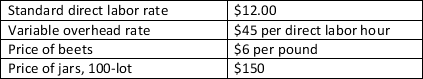

Percy requires ending Finished Goods inventory equal to 25% of the following month's sales.Other information is as follows:

What is Percy's overhead budget for April?

What is Percy's overhead budget for April?

Definitions:

Direct Materials Cost

The expenditure on raw materials that are directly involved in the production of a good or service.

Process Cost Summary

A report detailing the costs associated with each phase of the manufacturing process, showing material, labor, and overhead expenses.

Management

The process of directing, controlling, and overseeing the operations and activities of an organization or group to achieve its objectives.

Equivalent Units

A concept in cost accounting used to allocate costs to partially completed goods, treating them as if they were a certain number of fully completed units.

Q9: The key inputs for the direct materials

Q22: Chocolate Delight sells chocolate dipped fruit to

Q28: If the ending balance in Raw Materials

Q32: If the beginning balance in the Raw

Q45: Backyard Creations purchased 7,000 feet of copper

Q70: Assume R&N Manufacturing has always used a

Q79: What items decrease the following accounts: Raw

Q108: Which of the following is not a

Q163: Which of the following is not a

Q164: Assume that activity cost totals $180,000.The company