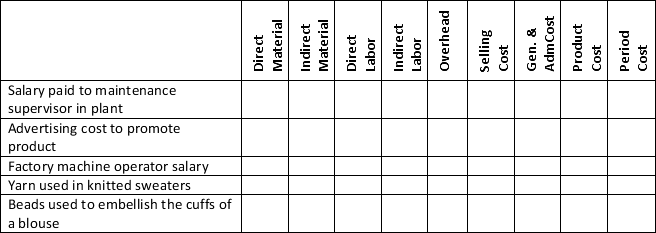

Complete the table below by placing an "X" under each heading that classifies the cost Items may be under more than one classification.

Definitions:

Basics of HRM

Fundamental principles and practices of Human Resource Management, which include recruitment, training, development, compensation, and performance management of employees.

HR Responsibilities

The duties and functions performed by the human resources department, including staffing, training and development, employee relations, and compliance with labor laws.

Administering Pay

The process of managing and dispersing salary and wages to employees within an organization.

Benefits

Various forms of non-wage compensation provided to employees in addition to their normal wages or salaries, such as health insurance, pension plans, and paid time off.

Q2: Practical standards represent a level of performance

Q13: Dana owns her own real estate agency.She

Q14: Short-term planning is often referred to as<br>A)Strategic

Q14: Which of the following items would

Q16: All other things equal,an increase in the

Q19: At the breakeven point,which of the

Q22: Grantham Manufacturing Company makes oak rocking chairs.Budgeted

Q46: A company is preparing its cash budget

Q105: Ethical behavior is<br>A)Always doing what benefits yourself

Q141: Contribution margin is the amount<br>A)That is available