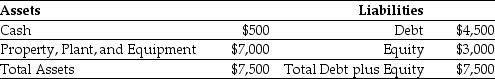

Use the table for the question(s) below.

Luther Industries currently has the following balance sheet (in Thousands of dollars) :

Luther is about to add a new fleet of delivery trucks. The price of the fleet is $1.5 million.

Luther is about to add a new fleet of delivery trucks. The price of the fleet is $1.5 million.

-Suppose the lease is a five-year fair market value lease, and the trucks have a remaining useful life of 8 years. If the monthly lease payments are $25,000 and the appropriate discount rate is 6% APR with monthly compounding, will the lease be classified as an operating lease or a capital lease for the lessee?

Definitions:

Income Ratios

A set of financial metrics that compare a company's income to other aspects of its financial performance or condition.

Liquidation

The process of winding up a company's operations and distributing its assets to claimants, often during insolvency.

Noncash Assets

Resources that cannot be quickly turned into cash or are non-liquid, like land, machinery, and intellectual property rights.

Income Sharing

An arrangement where profits or revenues are distributed among stakeholders, partners, or employees, based on a predefined formula.

Q10: Which of the following is not a

Q13: A lease where the lessee can purchase

Q14: Short-term planning is often referred to as<br>A)Strategic

Q19: Which of the following statements is FALSE?<br>A)

Q32: Which of the following questions is FALSE?<br>A)

Q35: Multinational firms often use currency forward contracts

Q64: The supply chain's goal is to<br>A)Avoid carrying

Q88: Equity holders have an incentive to _

Q92: _ is the relationship between the value

Q126: Indicate which of the following costs are