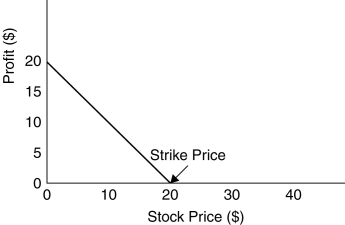

Use the figure for the question below.

-You have shorted a call option on WSJ stock with a strike price of $50. The option will expire in exactly six months. If the stock is trading at $60 in three months, what will you owe for each share in the contract?

Definitions:

Payoffs

The returns or gains received from a particular action or investment, typically used in the context of games or economic theory.

Player A

In the context of game theory, a label for one of the participants in a strategic interaction or game.

Player B

In game theory, a participant in a strategic situation or game, distinguished from other participants by the label "B".

Sherman Antitrust Act

A landmark U.S. legislation passed in 1890 that prohibits monopolistic business practices and promotes competition.

Q3: Using the covered interest parity condition, the

Q6: Suppose the domestic cost of capital for

Q18: In reality market imperfections exist that can

Q20: Which of the following statements regarding long-term

Q23: Consider the following tax rates: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg"

Q48: What is discount period?

Q49: Which of the following is a committed

Q60: Which of the following statements is FALSE?<br>A)

Q71: What is the implied assumption in percent

Q92: _ is the relationship between the value