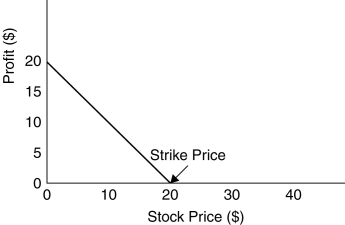

Use the figure for the question below.

-You have shorted a call option on WSJ stock with a strike price of $50. The option will expire in exactly six months. If the stock is trading at $60 in three months, what will you owe for each share in the contract?

Definitions:

Donors

Individuals who provide blood, organs, tissues, or other biological materials for medical purposes.

Acid-Base Balance

The mechanism that the human body uses to maintain a stable pH level in its fluids and tissues.

Respiratory Mechanisms

The physiological processes involved in the intake of oxygen and the release of carbon dioxide from the body.

Renal Mechanisms

The processes and functions carried out by the kidneys to regulate body fluids, electrolytes, and waste product removal.

Q6: What is the term used for a

Q23: In which of the following loans can

Q24: Tammy is a member of the Board

Q31: Which of the following are the three

Q34: A firm may announce its intention to

Q37: Which of the following statements is FALSE?<br>A)

Q49: A firm has $70 million in equity

Q58: Which of the following is the major

Q63: The amount of dividends a company pays

Q74: A firm issues two-month commercial paper with