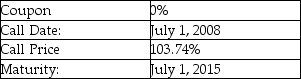

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $27.24. What is the minimum conversion ratio that would make a bondholder prefer to convert rather than accept the call price?

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $27.24. What is the minimum conversion ratio that would make a bondholder prefer to convert rather than accept the call price?

Definitions:

WACC

Weighted Average Cost of Capital, a calculation of a firm's cost of capital wherein each category of capital is proportionately weighted.

Risk Similarity

The degree to which different investments share similar risk characteristics.

Current Operations

The day-to-day activities involved in running a business, such as sales, maintenance, and administration, which directly relate to its main activities.

Flotation Costs

The expenses incurred by a company in issuing new securities, including underwriting fees, legal fees, and registration fees.

Q5: What kind of corporate debt can be

Q14: A firm issues $225 million in straight

Q18: By adding leverage, the returns on a

Q35: Managers should consider _ for external financing

Q36: Which of the following is NOT a

Q36: Based upon Ideko's Sales and Operating Cost

Q59: Which of the following statements is FALSE?<br>A)

Q85: Consider the following returns: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt="Consider

Q89: If a firm is planning an expansion

Q91: Which of the following statements is FALSE?<br>A)