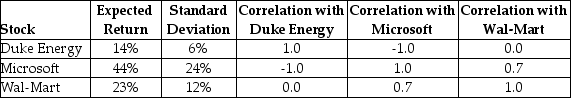

Consider the following expected returns, volatilities, and correlations:  The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

Definitions:

Pediatricians

Medical doctors specializing in the care and treatment of infants, children, and adolescents, focusing on physical, behavioral, and mental health issues.

Bottle-feeding

The method of feeding babies with milk or formula from a bottle, as opposed to breastfeeding.

Testosterone Declines

The natural decrease in testosterone levels in men as they age, which can affect mood, stamina, and sexual health.

Middle Adulthood

A stage of life, typically defined as occurring between ages 40 and 65, where individuals experience numerous social, emotional, and physical changes.

Q3: What are bond covenants?

Q8: An analysis that breaks the net present

Q13: After the repurchase, how many shares will

Q18: If you value a stock using a

Q19: Suppose you invested $93 in the Ishares

Q28: The optimal capital structure depends on _

Q36: The firm commitment process is the most

Q79: What is a bond's seniority?<br>A) the bondholder's

Q96: Internal rate of return (IRR) can reliably

Q103: Consider the following price and dividend data