Use the table for the question(s) below.

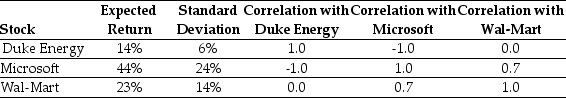

Consider the following expected returns, volatilities, and correlations:

-What diversification, if any, is achieved if two stocks in a portfolio are perfectly positively correlated?

Definitions:

Class Attendance Policy

A class attendance policy is a set of rules or guidelines regarding students' presence in class, as established by educational institutions to ensure consistent participation.

Cognitive Dissonance

A psychological phenomenon where an individual experiences discomfort due to conflicting beliefs, values, or attitudes.

Group Polarization

The phenomenon where discussions within a cohesive group lead to the adoption of more extreme positions or attitudes than initially held by individual group members.

Racially Prejudiced

Holding prejudgment, bias, or discrimination against individuals based on their race or ethnicity.

Q7: Jim owns a farm that he wants

Q26: Which of the following statements is FALSE?<br>A)

Q34: Which of the following statements is FALSE?<br>A)

Q35: Which of the following will NOT increase

Q39: The above screen shot from Google Finance

Q44: A janitorial services firm is considering two

Q44: A company issues a 20-year, callable bond

Q49: Which of the following is true regarding

Q55: An exploration of the effect of changing

Q93: A firm has a market value of