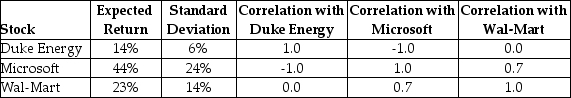

Consider the following expected returns, volatilities, and correlations:  The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

Definitions:

Licensing Revenue Model

Earning revenue by giving permission to other parties to use protected intellectual property (patents, copyrights, trademarks) in exchange for fees.

Intellectual Property

Legal rights that arise from the intellectual creativity of a person or company, including inventions, literary and artistic works, symbols, names, and images.

Fees

Payments made to professionals or organizations in exchange for their services.

Revenue Streams

Various sources of income that a business receives from its normal business operations or other investments.

Q2: Which of the following is NOT a

Q18: By adding leverage, the returns on a

Q21: The Valuation Principle states that the value

Q25: How does the size of an issue

Q45: Which of the following statements is FALSE?<br>A)

Q47: What are angel investors?

Q72: A firm incurs $40,000 in interest expenses

Q81: Martin is offered an investment where for

Q84: Assume Ford Motors expects a new hybrid-engine

Q94: A cash offer differs from a rights