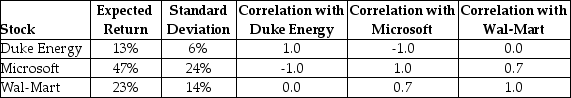

Consider the following expected returns, volatilities, and correlations:  The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

Definitions:

Marine Terraces

Flat, wave-cut platforms formed by the erosion of marine shores, marked by a rise in sea level or land level.

Sea Level Risen

The increase in the global average level of the oceans, attributed mainly to climate change and the melting of ice caps and glaciers.

Coastal Dunes

Natural accumulations of sand or sediment found along coastlines, formed by the wind and protecting inland areas from sea surges.

Equity Method

An accounting technique used to record investments in other companies, where the investment gives the investor significant influence over the investee, typically reflected as a percentage of the investee's net income or loss on the investor's balance sheet.

Q2: The Sisyphean Company is considering a new

Q3: Suppose you invest $22,500 by purchasing 200

Q6: Firms should use the most accelerated depreciation

Q38: A stock is bought for $23.00 and

Q73: Suppose Blank Company has only one project,

Q76: Diversification reduces the risk of a portfolio

Q77: Which of the following statements is FALSE?<br>A)

Q91: Aside from direct costs of bankruptcy, a

Q95: A portfolio has three stocks - 110

Q98: By definition, a preferred stock is a