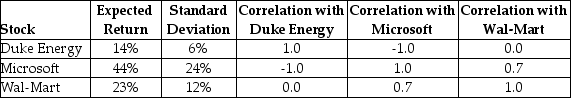

Consider the following expected returns, volatilities, and correlations:  The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

Definitions:

Control Group

The participants in an experiment who are as much like the experimental group as possible and who are treated in every way like the experimental group except for a manipulated factor, the independent variable.

Demand Characteristics

Features of an experimental study that inform participants of the purpose of the study or the behavior expected of them.

Research Cues

Essential elements or signals in a research setting that can influence participants' behavior or responses, often controlled or manipulated by researchers.

Participant Effects

The influence that the presence of participants in research may have on the results, due to their behaviors, attitudes, or responses being affected by knowing they are being studied.

Q17: Convex Incorporated sells 10 million shares of

Q27: Assume Ford Motors expects a new hybrid-engine

Q30: Interest and other financing-related expenses are excluded

Q42: A stock market comprises 4600 shares of

Q53: The founders and owners of a private

Q54: Iota Industries is an all-equity firm with

Q76: Diversification reduces the risk of a portfolio

Q100: You are offered an investment opportunity that

Q109: The manufacturer of a brand of kitchen

Q120: Investment A: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt="Investment A: