Use the table for the question(s) below.

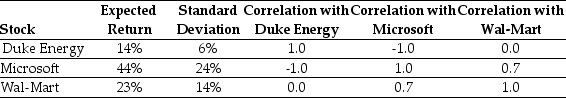

Consider the following expected returns, volatilities, and correlations:

-What is the lowest risk possible by selecting two stocks that are perfectly negatively correlated?

Definitions:

Late Antiquity

A historical period from approximately the 3rd to the 8th century, marking the transition from Classical Antiquity to the Middle Ages in Europe and the Mediterranean.

Utrecht Psalter

A highly important and influential illustrated manuscript produced in the Carolingian Empire around the 9th century, known for its unique pen drawings illustrating Psalms.

Risk Aversion

A dislike of uncertainty.

Bad Things

Negative events, actions, or outcomes that are undesirable or harmful.

Q5: Forecasting dividends requires forecasting the firm's earnings,

Q14: Firms that have many divisions with different

Q17: What is the major difference between scenario

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" A firm issues

Q24: Credenza Industries is expected to pay a

Q57: Convex Incorporated sells 10 million shares of

Q59: The Sisyphean Corporation is considering investing in

Q69: The volatility of Home Depot share prices

Q71: The capital budgeting process begins by _.<br>A)

Q94: Which of the following best describes a