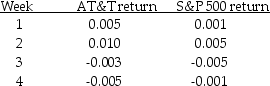

You observe that AT&T stock and the S&P 500 have the following weekly returns:  If this pattern of stock returns is typical of AT&T stock, and you calculated a beta against the S&P 500, which of the following is true?

If this pattern of stock returns is typical of AT&T stock, and you calculated a beta against the S&P 500, which of the following is true?

Definitions:

Risk-Free Rate

The risk-free rate is the theoretical return on an investment with zero risk, serving as a benchmark for measuring investment performance.

Market Risk Premium

The additional return an investor expects from holding a risky market portfolio instead of risk-free assets, critical for assessing investment risk.

Risk-Free Rate

The risk-free rate is the theoretical return on investment with no risk of financial loss, often represented by the yield on government securities.

Q1: UPS, a delivery services company, has a

Q5: Forecasting dividends requires forecasting the firm's earnings,

Q40: Which of the following formulas is INCORRECT?<br>A)

Q41: A maker of kitchenware is planning on

Q44: The market portfolio is the portfolio of

Q61: The Net Present Value rule implies that

Q64: Amazon.com stock prices gave a realized return

Q90: Agency costs arise when _.<br>A) there are

Q95: What is yield to call?

Q108: McCoy paid a one-time special dividend of