Multiple Choice

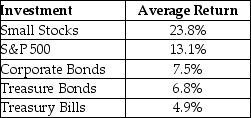

Consider the following average annual returns:  What is the excess return for corporate bonds?

What is the excess return for corporate bonds?

Definitions:

Related Questions

Q6: A company issues a ten-year $1,000 face

Q12: The volatility of an individual stock is

Q14: Firms that have many divisions with different

Q35: The discounted free cash flow model ignores

Q42: A company issues a callable (at par)

Q44: The credit spread of a bond shrinks

Q78: The sole way that a firm can

Q103: Which of the following statements is FALSE?<br>A)

Q105: A brewer is launching a new product:

Q107: A levered firm is one that has