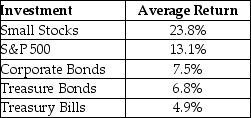

Consider the following average annual returns:  What is the excess return for corporate bonds?

What is the excess return for corporate bonds?

Definitions:

Narcissistic Personality Disorder

A psychological state defined by an enduring tendency towards excessive self-regard, a desire for others' recognition, and an absence of compassion for people other than oneself.

Vulnerable Narcissism

A form of narcissism characterized by hypersensitivity, defensiveness, and withdrawal in response to perceived criticism or failure.

Grandiose Narcissism

A trait characterized by an inflated sense of self-importance, need for admiration, and lack of empathy for others.

Narcissistic Personality Disorder

A mental condition characterized by a long-term pattern of exaggerated self-importance, a deep need for admiration, and a lack of empathy for others.

Q13: The security market line is a graph

Q16: A firm is considering several mutually exclusive

Q22: A delivery service is buying 600 tires

Q69: Divisional costs of capital are more appropriate

Q82: The pecking order hypothesis states that managers

Q83: Epiphany is an all-equity firm with an

Q89: Assume the total market value of General

Q92: Which of the following statements regarding best

Q96: Consider the following returns: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt="Consider

Q101: As we add more uncorrelated stocks to